SIMPLE CONSIDERATION OF INCOME TAX (PPh) FOR MSMEs IN BANDUNG CITY

Annisa Nurbaiti1*, Kurnia2, Muhammad Muslih3 , Achtar Rayhan Arief, Indah Nurul Rahadatul’Asy and Pascalis Gratio Vento Theonathan

Indonesia is one of the countries with the largest number of human resources in the world. According to the Minister of Cooperatives and SMEs, Teten Masduki, MSMEs as the driving force of the Indonesian economy are projected to increase to 83.3 million actors by 2034. This is an opportunity for the development of MSMEs to continue to be able to contribute to the Indonesian economy. The current problem of MSME players is the lack of a foundation of knowledge and understanding of taxation, especially on MSME tax rates. Some of the ways to improve the quality of human resources of MSME players is through increasing tax literacy.

MSMEs in Indonesia are not only the main pillar of the economy, but also the undisputed engine of growth. With a remarkable contribution to GDP of 61.07% in 2021, and the ability to absorb 97% of the total workforce, MSMEs are proving themselves to be a vital force in building an inclusive and sustainable economic future. This community service activity was carried out in collaboration between the Faculty of Economics and Business – Telkom University and PT Primasaga Sinergia Indonesia. The aim is to improve the knowledge and understanding of taxation of MSME players in Bandung, especially regarding the Simple Calculation of Income Tax (PPh) for MSMEs. In addition, the implementation of community service this time is also to support the implementation of the Tri Dharma of Higher Education.

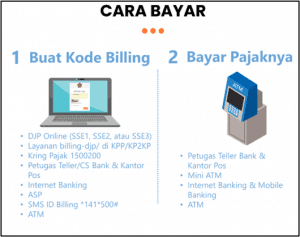

This service was organized by lecturers of the Faculty of Economics Business – Telkom University, namely Muhamad Muslih, SE, MM, Kurnia, S.AB, MM, Annisa Nurbaiti, SE, M. Si, Achtar Rayhan Arief, Indah Nurul Rahadatul’Asy and Pascalis Gratio Vento Theonathan on Friday, March 8, 2024. Before entering the core activities of the presentation of material on the introduction of simple calculations of MSME income tax, this activity began with a pre-test working on 20 questions to measure how far the knowledge of MSME players in Bandung City about financial literacy and ended with a post-test to see whether the material that has been explained can be understood well or not. The first material presentation was about taxation in general delivered by one of the speakers who is also a lecturer who has competence in the field of taxation. The material begins with a basic explanation of the definition of taxation, sources of state financing, differences between taxes and levies, the position of taxes, types of classification, nature, and tax collection agencies, tax collection systems, and tax rates. The second presentation was on the simple calculation of Income Tax for MSMEs, special rates and criteria for each business size, tax subjects, tax objects, and non-tax objects. The session ended with an explanation of how to report on the 1770 SPT form and how to pay using an ATM machine.

This service was organized by lecturers of the Faculty of Economics Business – Telkom University, namely Muhamad Muslih, SE, MM, Kurnia, S.AB, MM, Annisa Nurbaiti, SE, M. Si, Achtar Rayhan Arief, Indah Nurul Rahadatul’Asy and Pascalis Gratio Vento Theonathan on Friday, March 8, 2024. Before entering the core activities of the presentation of material on the introduction of simple calculations of MSME income tax, this activity began with a pre-test working on 20 questions to measure how far the knowledge of MSME players in Bandung City about financial literacy and ended with a post-test to see whether the material that has been explained can be understood well or not. The first material presentation was about taxation in general delivered by one of the speakers who is also a lecturer who has competence in the field of taxation. The material begins with a basic explanation of the definition of taxation, sources of state financing, differences between taxes and levies, the position of taxes, types of classification, nature, and tax collection agencies, tax collection systems, and tax rates. The second presentation was on the simple calculation of Income Tax for MSMEs, special rates and criteria for each business size, tax subjects, tax objects, and non-tax objects. The session ended with an explanation of how to report on the 1770 SPT form and how to pay using an ATM machine.

This taxation knowledge is needed by MSMEs to run their businesses, with this community service program it is hoped that it can help MSMEs in understanding tax calculations and reporting.